Personal loans makes it possible to do the reins of one’s financial coming. If or not your qualify for an unsecured loan depends on several items, among which can be your income. Loan dimensions, title length, credit rating, costs, other obligations additionally the supply of collateral is related. For every lender provides their particular program, which could itself feel flexible.

In short, there aren’t any easy responses regarding how much regarding financing you can get that have good $40,one hundred thousand paycheck. Yet not, understanding the techniques will assist you to put your better base pass whenever obtaining financing. Read on to obtain the full picture of just how earnings contributes to help you personal bank loan choices.

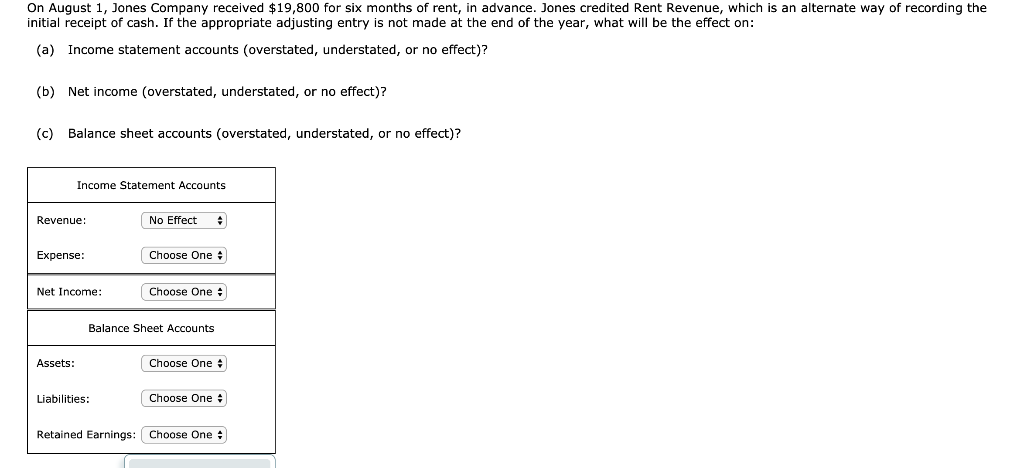

How come a good $forty,one hundred thousand salary influence your loan number?

A good $forty,100000 a year salary leaves your in the a stronger position to help you become approved for a personal bank loan for those who have a good credit score together with minimal financial obligation and you can expenditures. Although you can apply with the loan amount you prefer, its totally to the lending company how big of a loan giving therefore the terms. There is absolutely no common formula that lenders use to determine loan wide variety and approvals. Is the mortgage calculator from the OneMain to figure out financing proportions and you can monthly payment you can afford.

Because per lender keeps their unique standards and processes, you can check around for the right match. Get a hold of a fit for your book financial situation by getting pre-accredited first. It’s not going to apply at your borrowing from the bank and certainly will help you no inside the on financing that’s right for you. Lenders such OneMain Economic allow it to be easy to understand if you prequalify for a loan online.

New role of money within the financing behavior

When you are loan providers look at the financial fitness holistically, there are one or two a way to consider how your income situations in:

Debt-to-income ratio (DTI):It is an economic size one compares the month-to-month personal debt costs towards the disgusting monthly money. Whether or not not at all times theoretically „obligations,“ things such as book, home loan, mastercard repayments, almost every other finance and you may energy money make up your month-to-month „debt“ repayments. Try calculating the DTI yourself to obtain a good concept of simply how much out-of a personal loan you can afford which have an effective $40,000 a-year income.

Self-confident earnings trend: Earnings surface may give you more appealing so you’re able to loan providers. In the event your income might have been steady and also expanding on previous number of years, that may be more attractive than just if you’ve just become a beneficial $forty,one hundred thousand jobs. Loan providers want to see that you’re capable of making repayments in the near future while the establish.

In which carry out I get a consumer loan to possess a paycheck out-of $40,100?

With respect to unsecured loan lenders, you really have choice. Banks, credit unions and you may situated on the web lenders can every render a flaccid processes and you can aggressive terms.

Banking companies and credit unions: The college you already lender having will likely be a convenient place to begin your loan lookup. Yet clickcashadvance.com/installment-loans-pa/oakland/ not, on line lenders one to are experts in signature loans might possibly be a great solution when you are undergoing building debt fitness.

Individual loan providers: Loan providers for example OneMain Financial attract greatly towards personal loans. Really private loan providers try and benefit open to individuals who want it, although they truly are in the process of building their funds. Lookup several lenders observe what types of pre-accredited now offers is available. Or contact a loan expert to walk you from techniques. When you have constant questions regarding signature loans, read this article on what a consumer loan is and is not.

Monetary defense starts with economic discover-how

A consumer loan and a beneficial $forty,100000 annually salary are fantastic tools to own working to the the new coming. However, money is certainly one bit of new secret. Need certainly to tighten your financial budget? Saving having property? Should start using? Whatever the next amount of your bank account turns out, our free content towards the subjects including credit ratings, expenses, and you can budgeting helps you achieve your goals.

All the information in this post emerges getting standard knowledge and informational purposes simply, without the share or required promise of any kind, including guarantees out of accuracy, completeness otherwise physical fitness when it comes down to form of goal. That isn’t intended to be and will not constitute economic, judge, tax or any other pointers particular for you the user or anyone else. The businesses and people (except that OneMain Financial’s backed lovers) labeled inside content aren’t sponsors away from, do not endorse, and are generally not or even connected to OneMain Economic.